If you have no0t noticed the "Prep Talk" are geared to help you to do this.

You can approach this one of two ways, either get out of debt and go forward on a sound footing and protect you family that way. Or you can go so far in debt and go default on it when if the economy passes the point of no return. Either way carries a risk. One you risk living a more stress free life, and happier life you will be free to do as you please. The second is the road to ruination if nothing happens your credit will be ruined for ever (10 years plus) and with the tightening of credit it could ruin your chances for owning a house or vehicle.

I do like being able to go to Survival Blog and find references to 10 or more articles almost any day thanks to his Economics's Editor work.

One that has been alluded to several times in this blog is the inter-connectedness of the markets around the World. It has been extolled by the last few Presidents the "global economy". Well you can tell how well that is working, as our economy goes South so does a lot of the Worlds markets. But think about this when at some point in the near future we (the US) out of self preservation pull back our support and Bribes we pay them, it will effect a lot of Countries.

Have you ever considered the DEBT this Country has right now? You ought to go to

http://www.brillig.com/debt_clock/

As of last night it was at

U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt as of 05 Oct 2008 at 10:45:28 PM GMT is:

The estimated population of the United States is 304,854,553

so each citizen's share of this debt is $33,321.13.

$3.08 billion per day since September 28, 2007!

That is for every man woman and child here, right now. It is absolutely crazy. And we just are going to add about another 2 or 3 trillion to it with this bailout. You really are not very smart of you think that it is only going to cost 700 Billion. Once the Government starts to spend they won't stop.

Anyway here are a few articles of interest

Manipulation of Gold and Commodity Prices to Prevent Inflation and Higher Interest Rates

The Invisible Hand and the Pox Known as Usury - First, from Wikipedia, a little background on usury :Usury (pronounced /ˈjuːʒəri/ , comes from the Medieval Latin usuria , "interest" or "excessive interest", from the Latin usura "interest") originally meant the charging of interest on loans. After countries legislated to limit the rate of interest on loans, usury came to mean the interest above the lawful rate. In common usage today, the word means the charging of unreasonable or relatively high rates of interest…..

Profits from usury do not arise from any substantial labor or work but from mere avarice, greed, trickery and manipulation. In addition, usury creates a divide between people due to obsession for monetary gain. Most importantly, usury commodifies biological time for profit, which is linked to life, considered sacred, God-given and divine, leading to excessive worrying about money instead of God, thus subjugating a God-given sanctity of life to man-made artificial notions of material wealth…..

I began this paper with a broad definition of usury to explicitly point out, in an historical context; it has always been inextricably linked to ECONOMIC ABUSE .

Today is no different.

Interest Rates and Gold Joined at the Hip

Before delving into the nuts-and-bolts of how usury has been utilized in deceitful and harmful ways to perpetrate economic abuses upon mankind we should also grasp the historic relationship between GOLD and INTEREST RATES :

Historically, the gold price is a leading indicator as it tends to predict interest rates. When the gold price is high, interest rates tend to rise in the near future.

Gold as a leading indicator to interest rates is more obvious when gold price changes are plotted. Except for the last major upswing in interest rates in 1999, the gold price trend led interest rate levels by about a year.Also, it's important to remember that from an historical standpoint, money creation [absent productivity increases] IS inflationary. Inflation historically drives interest rates higher. The question then becomes, what happened to break-down the gold price, yet, send interest rates higher around the 1995 time period [above]?

Economic Laws state that this cannot have happened without good reason.

Refresher As to What Happened In 1995?

We need to wind our clocks and calendars all the way back to 1995, in the twilight of the first Clinton Administration. Sir Robert of Rubin was then Treasury Secretary and the U.S. government was facing default on its financial obligations due to a bitter, partisan debate causing delay on raising the debt ceiling. In the words of Robert Rubin himself in his book, In An Uncertain World, on page 170 he states,

“Without an increase, the federal government would hit the debt ceiling before the end of 1995, possibly as early as October. Default and the President being forced to sign an unacceptable budget were both untenable. We needed to find a way out, rather than simply hoping that at the last minute the opposition would blink and increase the debt limit.”

The ultimate response to this dilemma is chronicled by Rubin, on page 172, where he reveals,

“It was Ed Knight, our savvy chief Treasury counsel, who suggested borrowing from the federal trust funds on an unprecedented scale to postpone default.”

You see folks; as Mr. Rubin was well aware, the federal trust funds DO NOT AND NEVER DID CONTAIN ANY MONEY . These accounts exist in the minds of accountants and lawyers [ledgerdom] only. So here's what was going on:

Beginning Nov. 12, 1995, the Treasury started issuing government bonds, IOU's, and putting them in the Social Security Trust Fund “cookie jar” – with the Fed then PRINTING the corresponding amount of money they needed and called this a ‘legitimate loan'. By accounting for their finances in this manner, the government got to understate their annual budget deficits by the same amount that they were burdening the cookie jar with IOU's – all the while dramatically increasing the unfunded [off balance sheet] liabilities of the government by the same amount. Where I come from, this is neither savvy nor a loan. It is better described as treasonous, fraudulent and larcenous.

At the same time, the methodology for measuring inflation was undergoing rigorous fraudulent changes – which made a mockery of ‘then' Fed Chairman, Alan Greenspan's claims of a productivity miracle and, through the yeoman's work of John Williams [www.Shadowstats.com] was exposed for what they really were: deceitful obfuscations to mask profligate monetary policy being pursued by government. This deception was reinforced by the jaw-boning-ruse we know as the Clinton/Rubin/Summers “strong dollar policy”.

Market rates of interest are historically set at the real rate of inflation plus 250 basis points. The real rate is determined by backing out “inflation” from nominal rates of interest. By understating inflation, interest rates look higher [or more positive] than they otherwise would be.

The budding fraud depicted in the graph above shows that interest rates were behaving as they should but the gold price reacted counter-intuitively?

Why the Gold Price Dropped

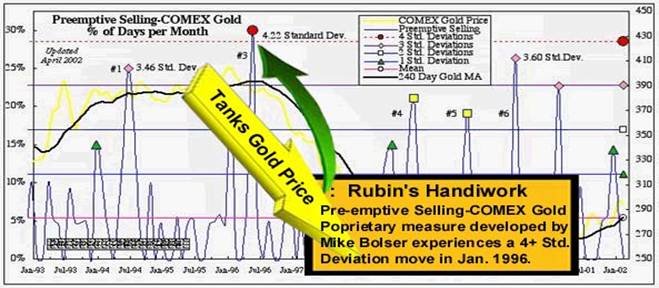

In late 1995, Rubin knew that the course being charted, Government profligacy, would naturally lead to a much higher gold price and higher rates; so, the Fed / Treasury [Plunge Protection Team] unleashed their “stealth” gold price suppression scheme, a direct hit from a golden-torpedo, in Jan. 1996:

In the chart above, mathematician Mike Bolser employs ‘ statistical regression analysis' to depict what amounts to forensic statistical accounts of how an ‘invisible participant' involved in the trade whose actions dictate they are not motivated by “profit maximization”.

“Preemptive selling, which is a fraud detection algorithm , measures very aggressive COMEX gold market selling when compared to the London gold market (LBMA). Table 1 displays the percentage of days per month in which the COMEX gold price falls 300% more than the London gold price. The probability of changing macroeconomics being the cause for such extreme New York price drops is highly diminished because the two markets trade the same commodity on the same day. Preemptive selling should not be confused with price volatility or rate of change, which are measures of rapid price fluctuation. In addition, preemptive selling is a measure of relative activity between two markets. Recall also that it does not measure the volume of comparative selling, only its effect as measured by gold market prices.”

With the gold price effectively “dead and buried”, there was still a problem that needed to be tended to – to prevent or stem the “Bond Vigilantes” from selling bonds in sufficient quantities to “ FORCE ” interest rates higher.

The solution to this part of the problem [rising rates] is where J.P. Morgan's [now] 93 Trillion Derivatives Book swung into action.

Embedded in every interest rate swap is a bond trade. In simple terms, the greater the volume of interest rate swaps – the greater is demand for bonds to hedge them. Ergo, if enough interest rate swaps are transacted – they serve as a “ VACUUM CLEANER ”, sucking up ALL MEDIUM TERM BONDS [3 – 10 yrs.] in their path.

In this respect, bond trading volume originating from the interest rate swap derivatives complex overwhelmed and supplanted traditional bond market participants. The motivations and risk tolerances between these two classes of “traders” are not necessarily consistent with one another – and in the extreme - manipulatively opposite to one another. We have been witness to the same type of phenomena in the precious metals arena where futures [COMEX and LBMA] prices have served to “trump” or suppress those which would be dictated by physical supply or demand. This is now manifesting itself in bifurcation of our capital markets – banks are now refusing to lend money at Libor [an interest rate futures derived price] because it is not reflective of their costs of funds and owners of physical metal are refusing to part with their precious at COMEX prices, because it costs more in many cases to mine it. This is evidenced by stiff and increasing premiums being paid for physical metal.

What's more, interest rate swaps being “off-balance-sheet items” – an untrained eye [or Bond Vigilante, perhaps?] was none-the-wiser as to why yields were counter-intuitively falling or remaining at low levels despite demonstrable inflationary pressures. According to the Office of the Comptroller of the Currency's [ archived ] Quarterly Derivatives Fact Sheets:

“J.P. Morgan's Interest rate swap book grew from 12.716 Trillion Notional at Q4/1995 to 14.7 Trillion at Q2/1996.”

Back in those days a couple of Trillion used to buy a lot of love, or respect.

Against this backdrop, bond vigilantes quickly joined the ranks of the “extinct” – acquiescing or losing their jobs - while interest rates, the primary efficient arbiter of capital – became fallacious and meaningless.

It was this GROSS mis-pricing of Capital and associated market rigging practices that facilitated ALL THE ASSET BUBBLES - from the contorted Dot Com Boom to the Real Estate debacles that followed.

To mask and obfuscate their ever heightening profligacy [if you consider 850 billion dollar bail-outs for Wall Street profligate], officialdom has increasingly relied on the handiwork of their agents in the derivatives markets of strategic commodities to suppress or cap prices – trying to turn back accelerating runs-on-banks. In this surreal set of circumstances, while fiat currency continues to self destruct before our very eyes, the saying that, “price action makes market commentary” leaves the mainstream financial press and unwitting market commentators babbling about rampant deflation even as these “bank-runs” and counter-intuitive physical shortages intensify.

Not by coincidence, if one reads an Introductory Economics Text Book, one would read that artificially low, negative real interest rates deter savings and encourage consumption and frivolous speculation while creating shortages of basic goods.

Does any of this sound familiar?

Welcome home, folks.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research.

Many of Rob's published articles are archived at http://www.financialsense.com/fsu/editorials/kirby/archive.html, and edited by Mary Puplava of http://www.financialsense.com/fsu/editorials/kirby/archive.html

http://www.marketoracle.co.uk/Article6619.htmlEuropeans scramble to save failing banks

October 5, 2008 - 6:50pmAP Business Writer

STOCKHOLM, Sweden (AP) - Germany became the latest country to move to allay fears about the financial meltdown, enhancing a rescue plan for Hypo Real Estate AG and guaranteeing private bank accounts as European governments scrambled on their own Sunday to save failing banks.

Chancellor Angela Merkel said that no citizen should fear for the safety of their investments. Hours later, her government announced a new bailout package totaling 50 billion euros ($69 billion) for Hypo Real Estate, Germany's second-biggest commercial property lender.

Hypo said an original euro35 billion ($48 billion) rescue plan fell apart after private lenders withdrew support, a key element to the proposal that had already been approved by the EU.

The deal was on top of the guarantees of private accounts. German Finance Ministry spokesman Torsten Albig said the unlimited guarantee covered some 568 billion euros ($785 billion) in savings and checking accounts as well as time deposits, or CDs.

At the same time, Belgian Prime Minister Yves Leterme said that France's BNP Paribas SA had committed to taking a 75-percent stake in Fortis NV.

Leterme said the Belgian and Luxembourg governments would, in turn, take a blocking minority share in BNP Paribas.

The deal came after two days of closed-door talks between the Paris-based bank, Fortis and government authorities in an effort to restore confidence in the company before markets open Monday.

In Iceland _ particularly hard-hit by the credit crunch _ government officials and banking chiefs were discussing a possible rescue plan for the country's overstretched commercial banks.

British treasury chief Alistair Darling said he was ready to take "pretty big steps that we wouldn't take in ordinary times" to help the country weather the credit crunch.

In the past year the government has nationalized struggling mortgage lenders Northern Rock and Bradford & Bingley.

"The European banking industry is feeling the wind of default blowing from the other side of the Atlantic," said Axel Pierron, senior vice president at Celent, a Boston, Massachusetts-based financial research and consulting firm.

The erosion has also injured overall confidence and caused concern among investors, politicians and the European public.

The leaders of Germany, France, Britain and Italy met Saturday to discuss the meltdown that has leapfrogged across the Atlantic from the U.S. to Europe, but shied away from action on the scale of the massive $700 billion bailout passed by the U.S. Congress on Friday and later signed into law by President Bush.

Their failure to agree to an EU-wide plan showcased the divisions in Europe on how to deal with the crisis.

France had suggested a multibillion-euro (multibillion-dollar) EU-wide government bailout plan, but backed off after Germany said banks must find their own way out.

French President Nicolas Sarkozy's top adviser, Claude Gueant, insisted that a "common European plan" had come out of the summit.

"What is certain and what the citizens of France and Europe must know is that their (banking) establishments won't be left in difficulty," he told Europe-1 radio on Sunday.

Icelandic banks expanded rapidly after deregulation of the domestic financial market in the 1990s and now have combined foreign liabilities in excess of 100 billion euros ($138 billion) _ dwarfing the tiny country's gross domestic product of 14 billion euros ($19 billion euros).

The government last week took over Iceland's third-largest bank, Glitnir, a decision that prompted major credit ratings agencies to downgrade both Iceland's four major banks and its government credit rating.

Looming large was a growing sense that the Federal Reserve and Europe's major central banks _ which have been flooding euros and dollars to banks that have grown increasingly unwilling to lend money even to themselves _ were ready to institute emergency cuts to their benchmark interest rates this week.

None of the banks, including the European Central Bank and Bank of England, have commented on potential rate hikes or cuts. But analysts believe the Bank of England, which meets this Thursday, will likely lower its rate below 5 percent. The ECB left its rate unchanged at 4.25 percent on Thursday, but opened the door to a rate cut.

Robert Brusca, chief economist at the New York-based Fact and Opinion Economics, said that the ECB does issue such a cut it would a be a sign "that they're really, really scared."

Financial Crisis: Fortis' Dutch assets are nationalised The Dutch operations of Fortis, Europe's largest victim of the credit crisis, have been nationalised in a €16.8bn (£13bn) deal aimed to calm investors in the troubled banking and insurance group. The Netherlands government stepped in to take over the assets, including buying Fortis' interest in ABN Amro – the Dutch investment bank it jointly acquired last year in a consortium with Royal Bank of Scotland and Banco Santander. Shares in Fortis have tumbled almost 70pc this year as fears mounted that it had overstretched itself through its €24bn participation in the ABN Amro transaction. Yesterday's deal replaces an agreement struck on Sunday by the Belgium, Dutch and Luxembourg governments to rescue Fortis by pumping €11.2bn into the Belgian-Dutch bank. Under that deal, they would have taken a 49pc stake in the bank's operations within each of their borders. This new transaction, which has been approved by the Dutch Central Bank, was announced after the Euronext market closed. Fortis' shares had earlier closed down 0.79pc to €5.42. Belgian Prime Minister Yves Leterme said the decision was "aimed at maintaining the durable solvency" of the banking and insurance group, which has become the first major banking casualty in the Euro zone of the global credit crunch. Dutch finance Minister Wouter Bos added that the move to fully nationalise the bank's Dutch operations was needed to prevent "the danger of infection" as investors still lacked confidence in Fortis, despite the bailout package announced earlier this week. "We have today ensured that savers and clients know their money is in safe hands in our banks," he said, explaining that savers had been withdrawing their money from Fortis and that other lenders were refusing to lend to the ailing bank. The nationalistion package comes just days after Fortis warned that the €2.15bn sale of its asset management arm to China's Ping An Insurance was likely to collapse due to "severe market disruption and the ongoing uncertainty in the global capital markets". It had also said the Dutch Central Bank had not approved its sale of several ABN Amro assets to Deutsche Bank for €709m.

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3131247/Financial-Crisis-Fortis-Dutch-assets-are-nationalised.html

French PM says world 'on edge of abyss'

PARIS/LONDON, Oct 3 (Reuters) - French Prime Minister Francois Fillon said on Friday the world stood on the "edge of the abyss", gripped by a global financial crisis now threatening industry, trade and jobs worldwide.

Fillon's words echoed a growing sense of alarm sweeping EU capitals ahead of an expected U.S. Congressional vote on Friday on a $700 billion bailout plan for the financial industry. Approval is far from certain.

The House of Representatives shocked world markets on Monday by rejecting a previous draft, wary of popular anger over the housing market collapse that triggered the crisis and high risk financial ventures that collapsed under the burden.

Prime Minister Fillon, whose country is hosting an emergency summit of Italian, British and German leaders on Saturday, said only collective action could solve the financial crisis. He said he would not rule out any solution to stop any bank failing.

"The world is on the edge of the abyss because of an irresponsible system," Fillon said, alluding to widespread anger over past lax regulation of financial markets and excessive lending.

Fillon said President Nicolas Sarkozy would propose at the emergency meeting measures to unfreeze credit and coordinate economic and monetary strategies.

European Central Bank President Jean-Claude Trichet sounded an alarm on Friday's expected vote in the U.S. Congress.

"(U.S. Treasury) Secretary (Henry) Paulson's plan obviously must be passed," he told Europe 1 Radio."It must be. It is necessary."

Bad news mounted in the European financial sector.

In Switzerland, UBS AG, hardest hit among European banks by its exposure to subprime-related holdings, said it would cut 2,000 investment banking jobs -- on top of the 4,100 positions cut in the past year.

Worries grew that even if Washington agrees on the package, it will not be enough to resolve deeper-rooted weakness. New data showed that a U.S. recession is nearing and Europe's economy is worsening.

"Investors expect the U.S. House to approve the bailout, but even if that happens, it would have a neutral impact on the market as its effectiveness is still questionable," said Takahito Murai, general manager of equities at Nozomi Securities in Tokyo.

A collapse in the U.S. housing market and resulting "bad mortgages" has undermined confidence in the financial sector, with inter-bank lending and credit to businesses and private individuals all but seizing up. Central Banks have injected billions of dollars to maintain some flow of funds.

UNILATERAL ACTION

Divisions have emerged within Europe over the past week, with Ireland offering guarantees on bank deposits, prompting a flight of capital from British lenders to Irish banks, and Greece promising to safeguard savers' cash.EU partners said Ireland's move could break competition rules and threatened the unity necessary to ensure an ordered approach to turmoil ahead.

U.S. payrolls data due to be released at 1230 GMT were forecast to show that businesses cut jobs for the ninth straight month in September, with 100,000 non-farm jobs expected to be lost, against a drop of 84,000 in August, according to the median in a Reuters poll of economists.

World stocks fell to a fresh three-year low on concerns the bailout would not be enough to prevent the U.S. economy and that of the rest of the world slowing further.

"Paralysis is spreading across the asset markets despite the various attempts by authorities across the globe to shore up confidence," the Calyon brokerage said in a not to clients.

House Speaker Nancy Pelosi said the bailout package would not be brought to the floor without the votes secured to pass it.

New economic data painted a bleak picture. U.S. factory orders tumbled in August and the number of workers seeking jobless benefits rose in the latest week to a seven-year high.

Oil rose above $94, supported by expectations that the House would approve the plan, which would then be passed into law by President George W. Bush.

Wall Street endured a dismal day on Thursday, as stocks dropped 4 percent and a seizing up in money markets drove a rally in the dollar.

(Additional reporting by Reuters reporters in New York, Washington, Singapore, Tokyo and Zurich)

http://in.reuters.com/article/businessNews/idINIndia-35785920081003dio.

Mexico feels our fiscal pain

By Chris Hawley, USA TODAY

NUEVO LAREDO, Mexico — Economists have their numbers, and taco vendor Jorge Flores has his.

From a half-empty parking lot at an industrial park, Flores measures Mexico's economic health in terms of steaming hot tacos, orange sodas and scoops of fiery green salsa. And the taco index is looking shaky.

"I used to come here with 300 tacos and sell them all before noon. Now I sell 180 in the same time," he says, pointing out factories that have cut hours, stopped overtime and frozen hiring. "I don't even come here on weekends anymore."

Like many Mexicans, Flores fears that the U.S. economic crisis is beginning to spill over to Mexico, the United States' biggest trading partner after Canada and China. Migrants are sending home less money, banks are tightening their lending, and U.S. consumers are buying fewer cars, televisions and other Mexican-made products.

"It would be a delusion to say we won't suffer some consequences of this great crisis," Mexican Treasury Secretary Agustín Carstens said in a speech last week. "Exports, tourism and (migrant) remittances are all going to feel the effects of this phenomenon."

Signs of trouble:

• Manufacturing exports to the United States dropped 3.8% in August, compared with the previous year, and that was before the U.S. stock market took a nose dive in September. Automakers were hardest hit, reporting a 13% decline in exports to the United States, according to Mexico's National Institute of Statistics, Geography and Information Processing.

• Consumer confidence since July is the lowest in at least six years, according to the Bank of Mexico's monthly survey.

• Mexico's IPC stock index declined almost 28% since May.

• Migrants sent home 12% less money in August compared with a year ago, the largest drop on record, the Bank of Mexico says. These remittances are Mexico's second-biggest source of foreign income, after oil sales, and totaled $1.9 billion in August.

Playing it safe

In Nuevo Laredo, on the border with Texas and the crossing point for 40% of all U.S.-Mexican trade, everybody from shipping agents to machinery makers are getting ready for a slowdown.

Trucks rolling into Mexico with U.S. goods or raw materials for factories are down to 4,000 a day from 5,000, says Fabian González, a Mexican customs supervisor.

Nuevo Laredo Mayor Ramón Garza says the decline is costing his city millions of dollars in customs duties that the Mexican Treasury Department shares with local governments.

At Herrajes Méxicanos, a metalworking company that supplies parts for factories, manager Ramón Baez says he cut his staff to 25 from 40 because of a recent 40% drop in sales.

One of his best customers is an electronics maker that buys metal weights to put inside telephone handsets. The client used to buy 70,000 weights a week, but now purchases only 10,000.

"All of my regular clients have lowered their orders," Baez says. "Everyone's waiting for the market to calm down."

In many ways, Mexico is still better off than the United States.

"Usually the people say that when the United States catches a cold, Mexico gets pneumonia. But this is not exactly the case today," President Felipe Calderón told a group of New York financiers last month. "Our country is now better prepared to mitigate the negative effects."

The government says Mexico is safe from a credit meltdown like that plaguing U.S. markets because of careful lending and tight banking rules put into place after Mexico's financial crash in the mid-1990s.

Bad mortgages are less of a problem, too, the International Monetary Fund said in an April study. Millions of Mexicans still build their homes one room at a time, buying blocks and mortar whenever they save the cash. Others buy houses through government mortgages guaranteed by contributions deducted from workers' paychecks. Private lenders, like banks, account for only one-third of mortgages.

The peso has remained strong between 10 and 11 to the dollar. The government is less dependent on foreign lenders, after reducing its foreign debt to 5% of gross domestic product over the last decade, from 40%.

What really worries business leaders is not a financial implosion, but less consumption — as average Americans and Mexicans get nervous about spending money, says Miguel Marón Manzur, president of Mexico's National Chamber of Manufacturers. "That is something that is going to be reflected in the entire exporting sector," he says.

That's bad news for border cities, which are already wrestling with a drop in cross-border tourism because of crime.

Silver lining

Still, Garza, the Nuevo Laredo mayor, and others say there may be a silver lining to the economic crisis, at least for Mexico.

A prolonged U.S. slump could eventually prompt American companies to move more work to Mexico to save costs, says Jaime Loera, president of the Nuevo Laredo Manufacturers Association. High fuel costs make it more expensive to ship goods from China, making Mexico more competitive, he says.

Much depends on how quickly the U.S. economy bounces back, says Carlos Montoya, managing director of another industrial park here. So far, no companies in his park have closed factories or canceled deals.

"There could be a drop, but I think we wouldn't see it until next year or so," he says. "It all depends on the duration of this situation we're living through."

http://www.usatoday.com/news/world/2008-10-05-Mexicofrets_N.htm?loc=interstitialskip

Special Report written by Bloomburg.com on "How We Got Here" IF you have a lot of time you can go through these article and see the pattern arise.

Libor Mystifies, Frightens Americans as Mayor Reads `Doomsday' Anisha Gupta, returning clothes to a Hugo Boss store on Rodeo Drive in Beverly Hills, shrugged when asked about Libor. She had heard the term. She wasn't sure she could define it.

FDIC May Need $150 Billion Bailout as Local Bank Failures Mount Deborah Horn tugs on the handle of the glass-paned entrance of the IndyMac Bancorp Inc. branch in Manhattan Beach, California. The door won't budge. The weekend is approaching, and Horn, 44, the sole breadwinner in a family of three, needs cash.

`Race to Bottom' at Moody's, S&P Secured Subprime's Boom, Bust In August 2004, Moody's Corp. unveiled a new credit-rating model that Wall Street banks used to sow the seeds of their own demise. The formula allowed securities firms to sell more top-rated, subprime mortgage-backed bonds than ever before.

Goldman Sachs, Morgan Stanley Bring Down Curtain on an Era The Wall Street that shaped the financial world for two decades ended last night, when Goldman Sachs Group Inc. and Morgan Stanley concluded there is no future in remaining investment banks now that investors have determined the model is broken.

Paulson Plan Seeks Value for Mortgages That Eluded Bear, Lehman U.S. Treasury Secretary Henry Paulson's bailout plan hinges on answering the question that has vexed global markets for more than a year and sunk two securities firms: What's a bad mortgage worth?

`Tectonic' Shift on Wall Street as Lehman Fails, Merrill Is Sold In the biggest reshaping of the financial industry since the Great Depression, two of Wall Street's most storied firms, Merrill Lynch & Co. and Lehman Brothers Holdings Inc., headed toward extinction.

Paulson Risks Goldman Standard as Fannie, Freddie Shares Erode As soon as he became secretary of the U.S. Treasury in July 2006, Hank Paulson started preparing for a crisis.

Lehman Hardest Hit by Biggest Rise in Borrowing Cost Since 2000 Bondholders are demanding the highest interest rates for Wall Street debt since 2000, threatening the industry's business model of acquiring assets with borrowed money.

Danger Ahead: Fixing Wall Street Is Hazardous to Earnings Growth Wall Street's money-making machine is broken, and efforts to repair it after the biggest losses in history are likely to undermine profits for years to come.

Bear Stearns's Schwartz Fought Collapse as Cayne Played Bridge Alan Schwartz wasn't supposed to be running Bear Stearns Cos., and now he is presiding over the 85- year-old securities firm's sale.

Subprime Securities Market Began as `Group of 5' Over Chinese Food Representatives of five of Wall Street's dominant investment banks gathered around a blonde wood conference table on a February night almost three years ago. Their talks over take-out Chinese food led to the perfect formula for a U.S. housing collapse.

Wall Street Shareholders Suffer Losses Partners Never Imagined Less than a decade after Wall Street's last major partnership went public, stockholders are paying the price for bankrolling the industry's expanding risk appetite.

Subprime Infects $300 Billion of Money-Market Funds, Increases Risk Money market funds were invented 37 years ago to offer investors better returns than bank savings accounts while providing a high degree of safety. Most of the $2.5 trillion sitting in these funds is invested in such assets as U.S. Treasury bills, certificates of deposit and short-term commercial debt.

Bernanke, Paulson Were Wrong: Subprime Contagion Is Spreading Federal Reserve Chairman Ben S. Bernanke was wrong.

Goldman, JPMorgan Stuck With Debt They Can't Sell to Investors Goldman Sachs Group Inc., JPMorgan Chase & Co. and the rest of Wall Street are stuck with at least $11 billion of loans and bonds they can't readily sell.

Moody's Lowers Ratings on Subprime Bonds, Standard & Poor's May Cut Moody's Investors Service lowered the credit ratings on $5.2 billion of bonds backed by subprime mortgages and Standard & Poor's said it may cut $12 billion of securities after criticism they waited too long to respond to rising home-loan defaults.

Standard & Poor's, Moody's Mask $200 Billion of Subprime Bond Risk Standard & Poor's, Moody's Investors Service and Fitch Ratings are masking burgeoning losses in the market for subprime mortgage bonds by failing to cut the credit ratings on about $200 billion of securities backed by home loans.

Bear Stearns Fund Collapse Sends Shock Through CDO Market Merrill Lynch & Co.'s threat to sell $800 million of mortgage securities seized from Bear Stearns Cos. hedge funds is sending shudders across Wall Street.

Banks Sell 'Toxic Waste' CDOs to Calpers, Texas Teachers Fund Bear Stearns Cos., the fifth- largest U.S. securities firm, is hawking the riskiest portions of collateralized debt obligations to public pension funds.

CDO Boom Masks Subprime Losses, Abetted by S&P, Moody's, Fitch The numbers looked compelling. Buy this investment-grade collateralized debt obligation and you'll get a return of up to 10 percent, Credit Suisse Group said. That was almost 25 percent more than the average yield on a similarly rated corporate bond.

http://www.bloomberg.com/apps/news?pid=specialreport&srnum=2USA 2008: The Great Depression

Food stamps are the symbol of poverty in the US. In the era of the credit crunch, a record 28 million Americans are now relying on them to survive – a sure sign the world's richest country faces economic crisis

Tuesday, 1 April 2008

We knew things were bad on Wall Street, but on Main Street it may be worse. Startling official statistics show that as a new economic recession stalks the United States, a record number of Americans will shortly be depending on food stamps just to feed themselves and their families.

Dismal projections by the Congressional Budget Office in Washington suggest that in the fiscal year starting in October, 28 million people in the US will be using government food stamps to buy essential groceries, the highest level since the food assistance programme was introduced in the 1960s.

The increase – from 26.5 million in 2007 – is due partly to recent efforts to increase public awareness of the programme and also a switch from paper coupons to electronic debit cards. But above all it is the pressures being exerted on ordinary Americans by an economy that is suddenly beset by troubles. Housing foreclosures, accelerating jobs losses and fast-rising prices all add to the squeeze.

Emblematic of the downturn until now has been the parades of houses seized in foreclosure all across the country, and myriad families separated from their homes. But now the crisis is starting to hit the country in its gut. Getting food on the table is a challenge many Americans are finding harder to meet. As a barometer of the country's economic health, food stamp usage may not be perfect, but can certainly tell a story.

Michigan has been in its own mini-recession for years as its collapsing industrial base, particularly in the car industry, has cast more and more out of work. Now, one in eight residents of the state is on food stamps, double the level in 2000. "We have seen a dramatic increase in recent years, but we have also seen it climbing more in recent months," Maureen Sorbet, a spokeswoman for Michigan's programme, said. "It's been increasing steadily. Without the programme, some families and kids would be going without."

But the trend is not restricted to the rust-belt regions. Forty states are reporting increases in applications for the stamps, actually electronic cards that are filled automatically once a month by the government and are swiped by shoppers at the till, in the 12 months from December 2006. At least six states, including Florida, Arizona and Maryland, have had a 10 per cent increase in the past year.

In Rhode Island, the segment of the population on food stamps has risen by 18 per cent in two years. The food programme started 40 years ago when hunger was still a daily fact of life for many Americans. The recent switch from paper coupons to the plastic card system has helped remove some of the stigma associated with the food stamp programme. The card can be swiped as easily as a bank debit card. To qualify for the cards, Americans do not have to be exactly on the breadline. The programme is available to people whose earnings are just above the official poverty line. For Hubert Liepnieks, the card is a lifeline he could never afford to lose. Just out of prison, he sleeps in overnight shelters in Manhattan and uses the card at a Morgan Williams supermarket on East 23rd Street. Yesterday, he and his fiancée, Christine Schultz, who is in a wheelchair, shared one banana and a cup of coffee bought with the 82 cents left on it.

"They should be refilling it in the next three or four days," Liepnieks says. At times, he admits, he and friends bargain with owners of the smaller grocery shops to trade the value of their cards for cash, although it is illegal. "It can be done. I get $7 back on $10."

Richard Enright, the manager at this Morgan Williams, says the numbers of customers on food stamps has been steady but he expects that to rise soon. "In this location, it's still mostly old people and people who have retired from city jobs on stamps," he says. Food stamp money was designed to supplement what people could buy rather than covering all the costs of a family's groceries. But the problem now, Mr Enright says, is that soaring prices are squeezing the value of the benefits.

"Last St Patrick's Day, we were selling Irish soda bread for $1.99. This year it was $2.99. Prices are just spiralling up, because of the cost of gas trucking the food into the city and because of commodity prices. People complain, but I tell them it's not my fault everything is more expensive."

The US Department of Agriculture says the cost of feeding a low-income family of four has risen 6 per cent in 12 months. "The amount of food stamps per household hasn't gone up with the food costs," says Dayna Ballantyne, who runs a food bank in Des Moines, Iowa. "Our clients are finding they aren't able to purchase food like they used to."

And the next monthly job numbers, to be released this Friday, are likely to show 50,000 more jobs were lost nationwide in March, and the unemployment rate is up to perhaps 5 per cent.

http://www.independent.co.uk/news/world/americas/usa-2008-the-great-depression-803095.html

No comments:

Post a Comment